My sister and I are the only 2 grand kids on my dad’s side of the family and 2 of 3 grand kids on my mom’s side of the family. To put it really lightly, between the parents and the grandparents we were absolutely spoiled. Now, granted, the majority of these items came from the Flea Market in Shawano or local garage sales because my grandma could not resist a deal (I understand now it was her way of showing us that she loved us). So because of that, we had everything. Not just one of everything, MULTIPLE of everything. I easily had 200 My Little Ponies, at least 60 different Polly Pockets, and every single Pokemon card (INCLUDING CHARIZARD) from 1 to 150….I won’t even tell you how many Beanie Babies I had, it might make you sick…(I know it makes me feel sick).

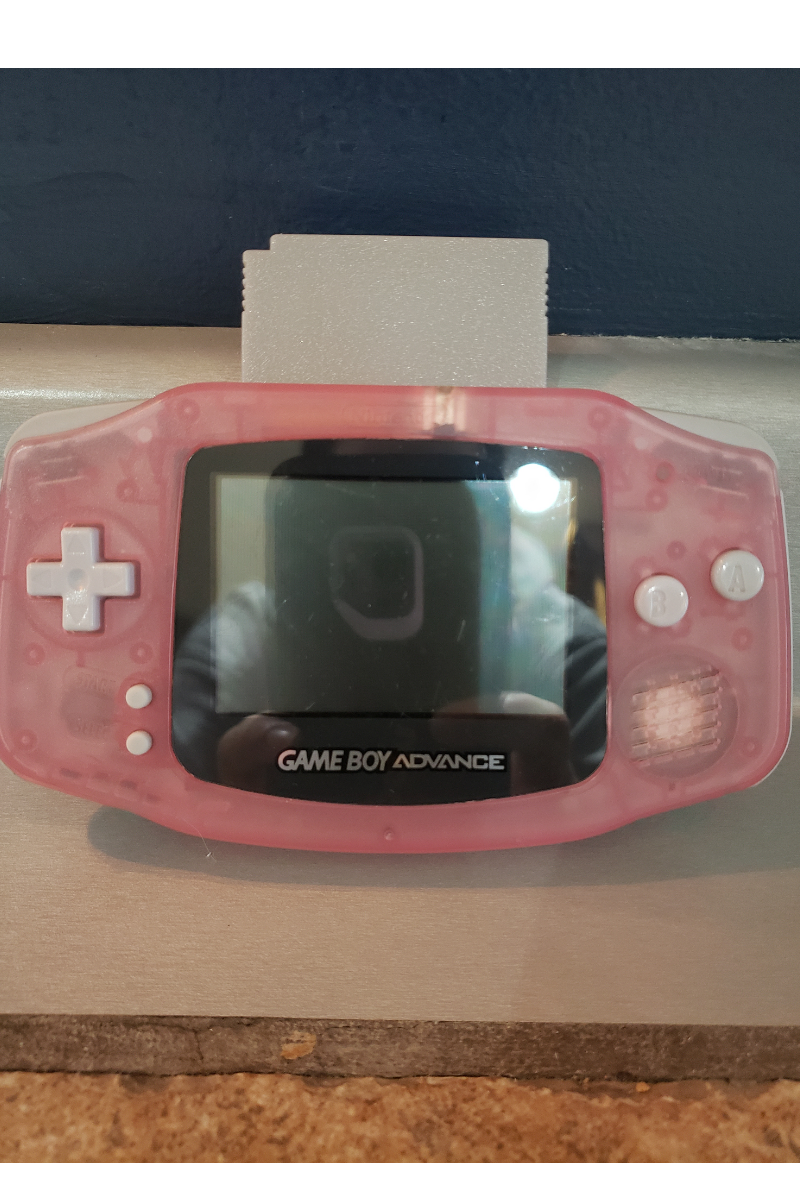

Overall most of the purchases that were given to us were (what I would now consider) quantity over quality. I was a kid I didn’t care, I was just happy to get presents! But eventually when 2001 came around, I wanted IN THE WORST WAY, a brand new PINK Game Boy Advance. I was going to catch all of the Pokemon on both Pokemon Gold AND Silver (I didn’t even care if they were practically the same game) and I was going to be a POKEMON MASTER. BUT…..no parent or grandparent wanted to fork out the $100.00 to get me this awesome new piece of technology. Now, I get it, I wasn’t the nicest and most careful with my electronics (which is why I had tape cassettes until I was 16…) so they didn’t want to buy it for me just for me to lose or break it. But they didn’t understand, that game system was going to CHANGE MY LIFE. I decided I was going to save my money and get it myself.

Up until then, every dollar I received whether from chores, birthdays, or the dollar bills that my Papa gave me walking out the door from visiting him, I spent immediately. I had maybe all of $20.00 in my NEW CU savings account, and that’s being generous. I would blow my money on candy, soda, and small little items from the Dollar Store. I was impulsive and as soon as I had the money, I needed to spend it to get instant gratification. So needless to say saving up $100.00 for this Game Boy, wasn’t going to be easy. But I started trying to save.

For a whole year I tried to save my money. I had a shiny Pokeball (one of those ones from the Burger King Happy Meals) as my “bank” and I had it sitting on top of my dresser. I would love to tell you that with integrity and stubbornness that I saved up every penny and went to Toys R’ Us (RIP) and bought me that dang Game Boy. But that’s not what happened. During that year I saved, I spent, I saved, I spent. I did not do well money managing. And then on my 12th birthday my Grandma gave me the Game Boy Advance I had so desperately wanted. I stopped saving my money and went back to my old habits, but rest assured, I fulfilled my destiny and became a Pokemon Master that summer.

When I was 15 I started working at the Coachlight Inn Motel and Express Video. It was fantastic to have cash flow, I could buy things! But I didn’t have a debit/credit card, and I didn’t get out of the house much besides work (I think I was grounded a lot) so I didn’t have a lot of opportunity to spend the money, which is good because somehow I was able to save up for my first car (1990 Pontiac Bonneville, she was beautiful)! This proved that I knew that money could give me what I wanted, but I had no idea how to manage it.

My car was paid for, I paid for my insurance, but I was living paycheck to paycheck. I graduated from high school and moved to college and I lived off of the money that I had gotten from graduation presents. That ran dry really fast. And then at 20 years old I applied for my first Credit Card at Scheels, to get a discount off of a purchase. And for every $200.00 I spent, I got a $25.00 gift card to Scheels, amazing!! I started treating it like cash flow, and not long after I was fueling my habits of instant gratification spending. But this time I was spending money that I didn’t have. I ran up credit card debt, paid my bills, and lived paycheck to paycheck. And then I got married.

Once you are married then money can become a whole different monster. I suddenly realized why the most common argument between spouses were about finances. Honestly, I was embarrassed, I felt ashamed, I felt unsuccessful and incapable. Although I had never been formally taught how to “budget” (besides balancing a check book back in 6th grade….) when I finally looked at my habits and my savings account, I knew I had to make a change for myself and for my family. I just wish I could have learned the importance of personal finance sooner, or even at least just the best uses for a credit card.

After teaching myself by trial and error, and after becoming a Certified Financial Counselor, I see it constantly. And maybe after reading my story you can relate too and agree that there is just not enough education about personal finance. 39% of people can not afford a $400.00 payment for an emergency, and for the longest time I was one of the 39%. It is so easy to get caught up in buying the next big thing when we are such a consumer driven society, but why does it need to be such taboo to talk about finances with people we care about the most? I had to break the cycle.

Once I was able to analyze my habits and learn the skills of budgeting I was able to release myself from the guilt of being unsuccessful. I made small changes like paying myself first in my emergency savings account and set aside savings. I set budgets for groceries, gas, and a spending/fun budget. I made a priority list of the things I was NOT willing to compromise on (cooking/food, mental and physical wellness/ travel) and list that I would sacrifice (new phones/ vehicle/subscriptions). I also budget bi- weekly at a time so I know what bills will be coming out before next pay day. But it doesn’t stop there. I regularly talk about finances and goals with Lucas, and we plan to start consulting with a Financial Advisor. Money isn’t going anywhere. I had to change my mindset from seeing money as “material success” into viewing money as a tool to help me live my best life in long term instead of getting what I wanted when I wanted it (I found out the hard way that that’s not always best). Its not easy to make changes, but there are ways to educate yourself (books, online courses, podcasts) and people out there who want to help you and want to see you living your best life (your Credit Union, your financial advisor, your family, me).

One day I hope to teach our children about being financially independent so they don’t have to feel the shame and guilt I felt. Maybe by then there will be a mandatory personal finance class in grade school that they will need to take to get their diploma. Then maybe, they too can save up their money and buy a new Game Boy and truly earn the title of Pokemon Master.

What does your relationship with money look like?

I just let your mom handle our money, and i’m good with that.

WHAT A WELL WRITTEN BLOG, I AM FASENATED BY ALL YOUR LIFE EXPERIENCES.

YOUR PARENTS MUST BE VERY VERY PROUD OF YOU, AND YOUR SISTER. FROM A FATHER’S PERSPECTIVE, MY HEART IS VERY WARM, AND FUZZY. KEEP UP THE GREAT JOB.

I LOVE YOU SO MUCH!! Thank you for reading!! My family is one of the best, I am really really lucky. 🙂

Hahaha! If it works why change it?! I love you!

Love everything about this post!! Are we related? LOL thank you Jen!!

HAHA! Maybe?! Thank YOU Wendy! See you tomorrow virtually!